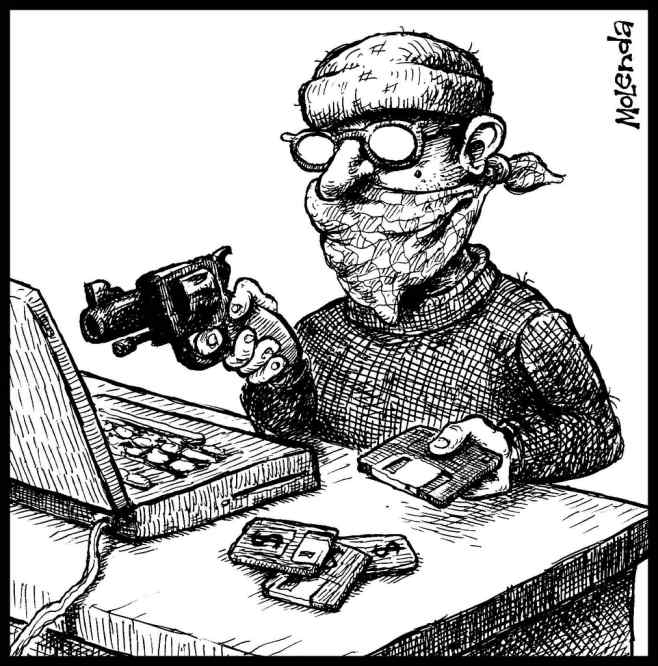

Image: © Michael Molenda It’s paradoxical that tougher penal sanctions for violating bank secrecy were enacted on January 1, 2009 – just 6 weeks after the FINMA’s (Swiss Financial Markets Authority) decision to release the names of certain UBS clients to the United States. Article 47 of the law governing bank secrecy was restructured to increase maximum prison sentences from 6 months to 3 years for bank staff who intentionally release client data to entities outside the financial establishment employing them. As for those who disclose data due to negligence, the maximum fines have risen from CHF 50,000 to CHF 250,000. So much for the law itself; but jurisprudence casts doubts on the determination to rigorously apply the law to its full extent. On January 19, 2011, an employee who was fired from Julius Baer after running the bank’s Cayman Islands branch for 8 years was sentenced to 240 finable days in lieu of prison time for taking client lists when he left. The prosecutor had initially asked for an 8 month prison sentence, a punishment which is substantially less than the maximum penalty under Swiss law. Just a few days later, on January 23, the same indiscreet former employee was held without bond for communicating a list of 2,000 banking clients to Wilkileaks. HSBC’s recent data theft is another case where Articles 271 and 273 of the Swiss Penal Code, concerning delivery of information to foreign administrations and espionage respectively, could certainly be applied. But in order for that to happen, the procedure instigated by the Attorney General’s office must actually get through the bureaucratic process. Although the banker formerly employed at Julius Baer was Swiss, HSBC’s ex-IT staff member is a French citizen with no particular ties to Switzerland and for whom exile to France could hardly be considered punishment. This case is particularly revelatory in that it clearly demonstrates all the weak points of the measures currently available to protect bank secrecy. Firstly, IT personnel are often hired by outsourced service companies and not by the bank itself.

Although such service companies are obliged to respect bank secrecy and are supervised by the FINMA, they do not have as strong a sense of company loyalty – not to mention corporate culture. Furthermore, large fund management banks such as HSBC are the product of several successive mergers and acquisitions which make them potentially more vulnerable. In fact, integrating a bank into the corporation that took it over entails data transfer and thus increased IT staff intervention. However, some of the IT experts involved in the process know that their jobs are just temporary positions and that the staff restructuring inherent in mergers will inevitably follow once their tasks are done. These psychological conditions are not conducive to reinforcing a sense of company loyalty to the bank employing such IT personnel… It is true that measures have generally been taken to implement IT structures limiting the consequences of any leaks, but it is in no way certain that they are universally applied with the same rigour. In theory, data regarding transactions are separate from personal information on clients, whose identities do not appear on statements relative to routine operations and various transactions. In this respect, small banks may be safer than large establishments and maintaining confidentiality has therefore become an important marketing tool for “third party managers”, otherwise known as independent money managers. It often happens that the directors of these establishments keep client data at their homes on a “stand alone”, which is a PC with no external connections. When this system is rigorously applied – which is far from the case due to the clients’ added costs involved – it is an appreciable element in terms of reinforcing confidentiality. Proof lies in the pressure foreign administrations are putting on Switzerland to provide administrative assistance based simply on an account number rather than having to furnish the client’s name and specify the bank in question, as is currently the case. If Switzerland concedes to this pressure, the whole double computer system method loses its purpose. For if no more than a bank account number suffices to instigate administrative assistance, precautions taken to limit accessing the client’s identity may become practically useless. Indeed, that's exactly what may well happen according to articles published in the Swiss press on Sunday February 6, 2011. One week later, the Federal Council announced that pending Parliament's approval it was ready to conform with OECD's new demands in principle. As early as mid-March, a parliamentary commission devised a very Swiss way of circumventing the issue – an account number may suffice, but only insofar as any demand for administrative assistance is made within the documented framework of an existing tax procedure. Even without waiting for Switzerland’s potential concession in this area, IT requirements and IT staff interventions diminish the utility of such precautions, although bankers don’t relish discussing the problem. For example, foreign banks avoid mentioning the occasional inspections by financial surveillance authorities from their respective home countries. Switzerland’s vigilance regarding foreign acquisitions of holdings in the banking sector is thus explained in light of the necessary links between the parent company and its Swiss subsidiary. This includes cases where the bank in question has limited company status which legally makes it a bank governed by Swiss law. But in the current age of globalization, supervising interventions on behalf of foreign administrations is getting a lot of bad press. Given the context, private banks have abandoned the sector's long-standing tradition of exclusively hiring Swiss citizens who reside in Switzerland, along with other deviations from a series of unwritten practices that are now becoming obsolete. Among the basic principles adhered to but not publicized, Swiss banks used to shy away from US soil.

Although as a rule Geneva's private banks continue to avoid opening branches in the U.S. they also refrain from managing assets belonging to “U.S. Persons” – even when those concerned live abroad. Credit Suisse and UBS have been very active on the U.S. market over the last decade, a break from their self-imposed, limited policy of the 1990s. As a result, both big Swiss banks have had to deal with endless litigation. Lastly, a former UBS investment banker, a Russian national based in New York named Igor Poteroba, was charged with leaking tips about potential mergers and acquisitions in March, 2011. Mr. Poteroba revealed confidential information to a fellow Russian citizen living in Chicago, Alexei Koval, a Northern Trust Bank employee who was also put into custody. A third Russian who was also threatened with arrest managed to avoid of the long arm of American law. An entire category of clients whose assets don’t exceed a few million francs may therefore find that the best way of guaranteeing confidentiality lies in avoiding multiple operations, particularly international transfers where citing the identity of the client requesting the transaction is mandatory. It’s possible to evade this requirement by simply sheltering behind an offshore account in jurisdictions which are less demanding in matters regarding client identification. But that expensive option may well become affordable to only the highest net worth individuals, whose managed assets exceed CHF 20 to 25 million. Individuals with lesser amounts of non-declared assets in Switzerland may be facing problematic situations, unless these funds concern precautionary savings. The situation Iranian banking clients (see boxed text) are experiencing is none the less likely to force foreign clients to re-evaluate their positions, although it’s still a bit too early to consider that a conclusive fact. The problems Iranians living in their own country are experiencing in transferring funds – should they fall under very specific conditions relative to sanctions – is nevertheless a more generalised rule. As a matter of fact, banks are required to not immediately transfer funds if they have reason to believe that said funds could be subjected to requests for judicial administrative assistance from a foreign nation. However, banks continue to successfully resist the obligation (designed to counter money laundering) to block a market order as a preventive measure based on the mere suspicion of insider trading. The logistical problems that this new mandate to block funds and report the client to the corresponding Communications Department of Switzerland’s Federal Administration in Bern entail are simply incompatible with the speed stock market operations demand. On the other hand, once the operation is concluded the bank can slightly delay transferring the assets to another establishment or depositing them in the client accounts. Even in cases where administrative assistance is not requested, the bank can still terminate relations with the client if suspicions about a market order become persistent. In this regard, there is a lack of means to establish facts in foreign markets which is compounded by the problem that the banks only have three databases to work from – 2 of which entail costs, whereas the third is none other than Google. In the Internet era, the old adage of “to live happily, live hidden” is more а propos than ever. Showing one’s hand in any way can very quickly land the client in a “heightened vigilance” category under the law concerning money laundering (LML) and the mandates for its application. The regulation regarding “politically exposed persons” (PEP) has just been reinforced and will be enacted on February 1, 2011 along with the LRAI, the law on assets with illicit origins. This law specifically applies to cases where the assets concerned belong to a political player from a nation that does not have the infrastructure needed to formulate a request for administrative assistance following mandatory Swiss judicial procedure. This law was immediately applied to block Duvalier’s funds and 10 days later, Mubarak’s assets were frozen less than an hour after his fall from power – another action which confirms an equivalent political determination.

A DISCREET WAVE OF PANIC HITS IRANIAN CLIENTS If the measures taken regarding leaders of nations that can only be considered dictators are not worrisome for Swiss banking clients, the same is not true of applying sanctions decided against Iran on January 19, 2011. Switzerland had already imposed sanctions established by the UN as of February, 2007, but the latest measures are now more limiting and follow recommendations made by the United States and the European Union. The intense pressure to rally around the cause meant that Switzerland had no choice but to give in and – all things considered – the measures announced on January 19 are relatively moderate. Clients residing in Iran must request an authorisation for transfers exceeding CHF 50,000. A simple declaration suffices for transfers starting from CHF 10,000. However, the few banks that still have Iranian clients had to show such restraint during the 2 weeks it took the State Secretariat for Economic Affairs (SECO) to publish the new forms on February 4, that Iranian clients – and their fund managers – came away with the impression that Swiss banks had imposed a generalised freeze on all assets owned by Iranian nationals. In some cases, clients were refused transfers of amounts below CHF 10,000 or were unable to sell stocks preceding requests to transfer their funds to friendlier climes. This actually concerns relatively small accounts belonging to clients who keep precautionary savings in Swiss banks. The fact that these clients are now thinking about transferring their accounts to the EU – and in one case to London – may seem paradoxical. In the long term, it’s a matter of knowing to what extent the situation these Iranian clients, who have no ties to the Iranian government in principle, are experiencing constitutes a precedent. The answer will partially depend on the SECO's (State Secretariat for Economic Affairs) position on the matter, as the SECO faces the difficult task of managing the policy authorising transfers established by the January 19 mandate. In Bern, it may seem that the trend is to play down the situation, but that yet remains to be seen.